Solar as an Energy Partner Power Production’s Paradigm Shift

Much discussion and news about solar energy has occurred lately prompted largely by the Solyndra bankruptcy and the federal loan guarantees, which took taxpayer dollars down with the Company. In fact, the Solyndra debacle generated enough press for the solar industry to become a partisan political topic with the House passing a “No More Solyndra” bill. Additionally, the United States announced import tariffs on Chinese solar modules after concluding the Chinese government was unfairly subsidizing the manufacture of their modules. The resulting image of solar as a government dependent industry too expensive to stand on its own is widely considered to be an accepted fact. In addition to this negative PR, the solar manufacturing industry has seen radical decreases in share prices of its major players and is undergoing a broad phase of mergers and general consolidation.

Despite these headline issues, the world is in the midst of a solar industry boom, which is fueling tremendous beneficial change. Simply stated, the industry woes that the public has heard about are exactly why solar is poised to make a massive contribution to the U.S. energy mix. All of the negative news is fueled by one basic fact: The market price for solar modules has dropped so quickly that the financial health of many manufacturers cannot keep pace. As a result, solar electricity pricing is also falling at a precipitous rate, and that is great news for a U.S. energy landscape in serious need of new generation sources.

Solar Industry Market Facts

The solar industry is one of the fastest growing sectors in the U.S. economy – making significant strides in both installed solar power capacity and even solar manufacturing.1 In fact, the U.S. solar photovoltaic (PV) market boomed in first quarter 2012, according to GTM Research and U.S.-based Solar Energy Industries Association (SEIA). And, solar installations reached 742MW in the second quarter, up 45 percent over the prior quarter, with a 116-percent increase compared to the same period one year ago.2 Utility-scale projects accounted for 447MW, with the full-year forecast for PV installations at 3.2GW, up 71 percent on record levels set in 2011.3 Solar can help the nation reduce greenhouse gas emissions, move toward fuel independence and, as solar approaches grid parity, become an integral and economical “power partner” in the overall energy mix while driving innovation and investment.4

Solar as a Viable Energy Partner

Grid parity, or the ability for solar to compete on a level playing field with mainstream generation (coal, nuclear and natural gas), could happen as early as 2014. Solar is critical for generating cost-effective peak generation energy, which is important given that in 2010 U.S. electricity generation was 4,361 billion kWh gross with annual electricity demand projected to increase to 5,000 billion kWh by 2030.5

Currently, 46 percent of the nation’s electricity is generated from coal-fired plants, 23 percent from gas, 19 percent from nuclear and 6.5 percent from hydro. Even without government subsidies, utility scale solar projects will reach a price per KWh that will be at, or less than, traditional generation possibly as soon as 2014. This projection is based on Principal Solar’s trend-line analysis of the drops in panel and “balance of system” costs discussed in this article.

A Brief History of Solar Growth

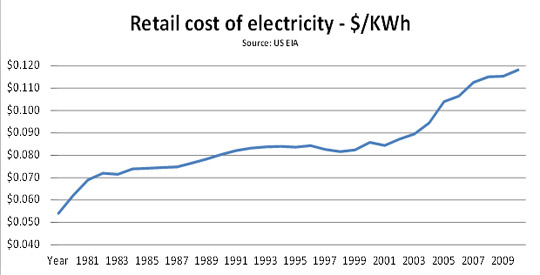

The cost of electricity has been rising year after year since 1980 even though the rate has significantly flattened recently as a result of inexpensive and abundant natural gas.

Image Courtesy of Principal Solar

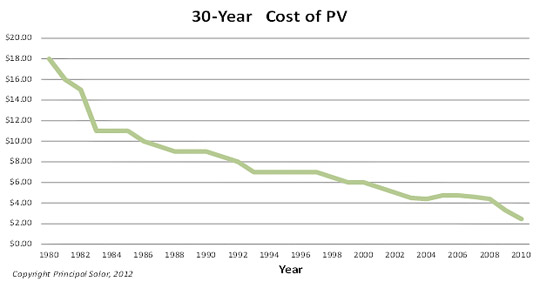

For many years, solar power was not a viable alternative energy source, but the cost of PV went down year after year (see graph below) as the retail cost of electricity rose (see graph above). The curve depicting the declining cost of PV is exponential.

Image Courtesy of Principal Solar

Note that from 2005 to 2008, the cost of PV rose and maintained this level in response to a significant transition in the industry when a substantial volume of solar parks were being constructed in response to 2004 revisions to the feed-in tariffs in Germany.6 This created demand for materials on a large scale to meet demands of solar farms. During this time, the silicon industry adapted and began refinements, which would ultimately drive a new trend line in decreasing PV costs.

To understand this, consider the small size of microchips compared to the large size of solar farms. For the past eight years, silicon manufacturers have been developing new methods of mass production on a scale that is (potentially) of a magnitude greater than historical demand while simultaneously developing efficiencies to dramatically lower costs.

Estimates suggest grid parity will occur when solar panels can be produced for under $0.70/watt coupled with a balance of system cost of $1.10 per watt. Stated differently, grid parity occurs when the total installed cost of a solar plant is approximately $1.80 per watt. This number is based upon the total cost of a system and financing a large-scale project, using the same methods for financing a new combined cycle gas-powered generating facility. Referring to the chart above, 2010 PV was approaching $2 per watt.

Comparison of Power Production

1. PV Solar

PV solar is made from one of the Earth’s most abundant resources: silicon. It has no moving parts and, as long as the sun continues to shine, the fuel is free. Of the 92 elements found on the periodic table, silicon (Si) is the Earth’s most prevalent semiconductor and second most common element of any kind after oxygen. Appearing in silicon oxides, such as sand (silica), quartz, rock crystal, amethyst, agate, flint, jasper and opal, silicon makes up about one quarter, by weight, of the Earth’s crust.7 It is clean, renewable and abundant.

As for cost, in response to growing demand for renewable energy sources, manufacturing of solar cells and photovoltaic arrays has advanced considerably in recent years. With continued advances in technology and increases in manufacturing scale and sophistication, the cost of PV will continue to decline steadily resulting in competitive electricity in a growing number of regions. The annual exponential drops in the cost of solar will not only result in competitive electricity but also in cheaper electricity coupled with higher profit margins for the industry. Note that as PV continues to become more of a commodity, the price will continue to decline, even below the grid parity point.

2. Nuclear

The nuclear power industry carries with it concerns about reactor safety, waste disposal and other environmental issues. In the early 1990s, the United States had twice as many operating nuclear power plants as any other country, thus representing more than one-fourth of the world’s operating plants and supplying almost 22 percent of the electricity produced in the United States.8

Furthermore, nuclear power is extremely reliable. In fact, the 104 U.S. nuclear reactors produced 807 billion kWh in 20109 and provided a significant portion of the income for power companies from May to September when most energy is consumed to cool air. This makes nuclear power an important piece of base load. In addition, it is estimated that the worldwide supply of uranium ore is sufficient to fuel deployment of 1,000 reactors throughout the next one-half century.10

While nuclear power is, for the most part, safe, clean and reliable, one critical problem with nuclear power plants is the enormous upfront cost; they are extremely expensive to build. While the returns may be great, it can sometimes take decades for investors to recoup initial costs.

3. Coal

Coal is cheap and abundant, but it is also dirty. Coal creates a dangerous work environment and generates huge amounts of air pollution in the form of hydrochloric, sulfuric acids and mercury air emissions, which occur mainly from coal combustion.11

The United States possesses coal in great abundance with estimates projecting a 250-year supply.12 It is much cheaper per BTU than oil and natural gas, and it is simple and safe to transport and to store. New Environmental Protection Agency (EPA) rules, however, present a challenge for coal-fired plants because no easily accessible technology can bring their emissions under the required limit.13

In addition, political barriers have escalated exponentially in the past 10 years, which is likely to damage plans for new coal generation and put pressure on older plants.14 In 2007, 59 proposed coal plants were cancelled, abandoned or placed on hold by sponsors as a result of financing obstacles, regulatory decisions, judicial rulings and new pollution legislation.15

4. Natural Gas

Of the “Big Three” power sources (coal, oil and natural gas), natural gas is a more attractive choice because it is cleaner, abundant and reliable. In fact, the Energy Information Administration (EIA) estimates that of the 96.65 gigawatts (GW) of new electricity capacity, which will be added in the United States through 2015, more than 20 percent, or 21.2 GW, will be natural gas additions. The latter will account for 80 percent of all added electricity generation capacity by 2035.16 In addition, recently built power plants fired by natural gas meet new EPA standards.

While North America has an abundance of natural gas, it is a non-renewable resource, having formed throughout thousands and, possibly, millions of years. EIA estimates that 2,543 trillion cubic feet of technically recoverable natural gas exists in the United States, including undiscovered, unproved and unconventional natural gas.17

A number of experts project a U.S. natural gas supply of up to 200 years. While the price of natural gas has been volatile, today it hovers around $2, thus making natural gas power plants very efficient.

Solar PV’s Big Leap Forward

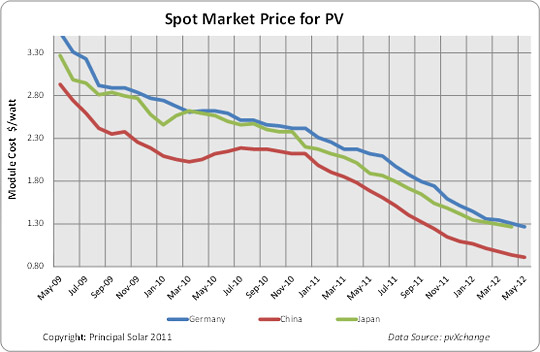

In early 2012, solar PV began to approach grid parity, and it is almost there. In looking at the spot market price for PV from 2009-2012, the same downward trend in cost exists for PV in Germany, China and Japan. (See graph below.) Because China has less expensive labor, it is understandable that this labor-intensive industry produces a lower cost product in China than in Japan and Germany.

Image Courtesy of Principal Solar

The chart above shows the May 2012 spot price of (Chinese) PV to be $0.91 per watt. Extrapolating two years from this trend line, and assuming a continuing trend, solar PV may reach $0.70/kWh by 2013 and could be as low as $0.50/kWh by 2014. These numbers are supported by many of the largest solar cell and PV manufacturers. The projected 2014 price will make solar PV not only competitive with but also less expensive than nuclear, coal and natural gas.

Power Production Cost Analysis

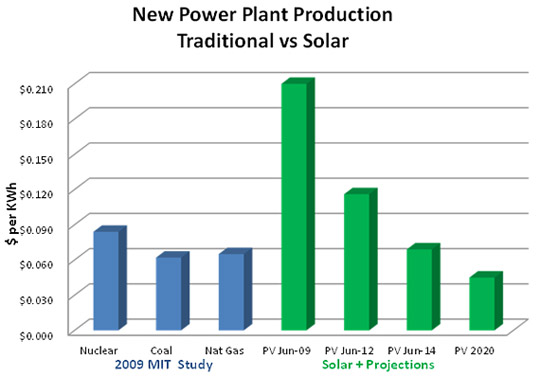

In an apples-to-apples comparison, take the 2009 MIT study18, which evaluated the resulting cost per kWh (blue) of new plants that would be constructed in 2009, and then add the cost per kWh (green) of solar built in the same period. Clearly, building a nuclear, coal or natural gas power plant produced significantly lower electricity rates than solar PV. However, as of January 2012 solar began to approach grid parity with nuclear being somewhat less expensive and coal and gas still cheaper. In 2014, solar and natural gas are level, and coal costs less, although a coal plant will probably cost more to build than it did five years earlier in 2009. From these projections, 2014 is the year solar may reach parity with the Big Three. Leaping further into the future, in 2020 solar will cost one-half as much as its competitors, according to this comparison. (See graph below.)

Image Courtesy of Principal Solar

Solar Energy as a Power Partner

It is important to remember that solar only generates when the sun is shining, so backup is critical for any solar installation. Nuclear and coal need to run 24 hours per day because when a nuclear or coal plant is shut down, it takes hours and even days to restart. Natural gas, on the other hand, can start in minutes, which is why solar and natural gas work well together compared with nuclear power and coal. Many calculations and approximations have been made on how many years of natural gas exist. Clearly, utilizing solar as a supplement to natural gas will extend that supply. It is not economically feasible to assume that the existing, operating, depreciating portfolio of electricity generation in the United States will simply be mothballed when solar pricing reaches or dips below grid parity. Instead, the most efficient, existing power plants will continue to provide base load electricity while new solar generation can and should provide peak load electricity in mid-day when the sun is shining. Much like a freeway system, pinch points in electricity generation occur for small amounts of time relative to the whole day. However, unlike freeways that grind to a standstill during rush hour, electricity grid operators do not have the luxury of limiting capacity to average load periods. Consumers require sufficient generating capacity for peak load, and solar as a power partner is an ideal solution for this problem.

This paradigm shift towards solar as a power partner, driven by continuing decreases in cost to deploy PV generation, means that a new investment opportunity is being created now. Conservative investors have traditionally placed capital in utilities because of the stability of returns based on a fixed, captive customer base. As solar continues to become more cost effective, it too will function as a traditional utility investment but without the same volatility of existing generation sources. With no fuel costs and low labor and maintenance costs, more institutional investors are paying attention to the returns they can earn with solar energy.

Ultimately, solar must be able to compete on an even playing field without subsidies. Based upon the above projections, this should happen in the coming years. Unused land throughout the desert southwest represents an abundant natural resource of energy. In fact, one county in western Texas receives enough sunshine to provide the entire needs of the United States for the next 50 years.

People may compare the next few years to a gold rush as billions of dollars are earned from converting sunlight to electricity, especially since solar will provide carbon credits rather than carbon costs when compared to coal, nuclear and gas-fired power plants. As an addition to the nation’s power needs, solar is positioned to ease congestion in energy-stressed grids, to provide affordable power and to produce electricity at a price equal to or less than its competitors. To keep the solar industry booming into the future – and to achieve the kind of innovation that leads to beneficial environmental change – it is more critical than ever to invest in solar today.

© iStockphoto.com/hatman12