URS, sROI & RISQUE Analysis Transformational Outcomes

Economics is known as the “dismal science.” Its study and application has never known a widespread understanding for most people beyond simple “supply and demand.” In an era of heightened fiscal accountability in both private and public sector endeavors, it is more important than ever to use sound economic analysis to develop, fund and construct projects, which are not only sustainable but that also demonstrate responsible stewardship of Earth’s finite resources. The days of utilizing green strategies for “feel good” aspects only are gone. Clients require delivery of a quantifiable risk analysis process to address the impact of sustainable strategies. Subsequently, architecture and engineering professionals now have to consider a more rigorous analysis of financial returns through use of economic analysis that is inclusive of the financial components of sustainable efforts. Establishing strong benchmarks and understanding monetary implications of sustainability measures – not just in terms of environment but in terms of larger societal impacts as well – is paramount.

URS’ history with risk analysis dates back almost 12 years to work completed under the Triple Bottom Line (TBL) approach for clients in a wide variety of industries from water resources and mining to environmental studies and manufacturing. The firm employs two rigorous methodologies for analyzing and documenting these strategies. One methodology is the Risk Identification and Strategy using Quantitative Evaluation (RISQUE) method – a multifaceted approach designed to help business managers make informed, defensible decisions as part of a triple bottom line management strategy. RISQUE provides an auditable and transparent risk and uncertainty management process assessment. Complex data is translated into expressions of financial impact, allowing the building team to formulate strategies for risk minimization and off-sets, to make sound business decisions and to guard against risk. This offers stakeholders a clear understanding of strategic and business risks.

URS Business Risk Strategies Group Leader Adrian Bowden, PhD, developed the RISQUE method. He subsequently co-authored one of the first books on the subject in 2001, Triple Bottom Line Risk Management – Enhancing Profit, Environmental Performance and Community Benefit (John Wiley & Sons, Inc.). Bowden, who has been at the forefront of TBL analysis in the infrastructure world, states: “Business risk is a condition involving exposure to events that would have an adverse impact on a company’s objectives. Business risk is, therefore, a combination of the likelihood of an event occurring and the magnitude of its consequences.”

Image Courtesy of URS Corp. | Three Spheres of Sustainability

Another methodology for evaluating various sustainable, environmental and energy strategies, and their potential outcomes on a project, is sustainable Return On Investment (sROI). Application of this method can be utilized on a wide variety of project strategies in support of a client’s goals or mission. sROI methodology utilizes TBL risk analysis to balance decisions based on a true accounting of social and environmental costs and benefits in addition to capital costs. A variety of potential outcomes for specific strategies can be evaluated using state-of-the-art risk analysis and Monte Carlo simulation. The ideal approach utilizes all project stakeholders in an open, transparent process. This process is non-proprietary in nature and utilizes “off the shelf” software. The open nature of such processes is critical as it allows a more widespread adaptation in both private and public sectors. It documents economic impacts of various strategies the team decides to evaluate, and it is valuable for documenting financial impacts of strategies either adopted or eliminated from consideration. Documentation of this process is critical as stakeholders can change through time, along with the need to revisit past decisions.

Sustainable Return On Investment is a methodology for measuring extra-financial value, such as environmental and social value not currently reflected in conventional financial models. sROI analysis accounts for full economic, social and environmental impacts of projects, helping to optimize design, evaluating impact on stakeholders and reducing potentially negative ecological outcomes. Many benefits (energy saved, water conserved, improved community values, improved safety or efficiency, improved patient outcomes, improved staff productivity) can be expressed in monetary terms and compared with other financial decisions. Traditional financial models, such as Life-Cycle Costs Analysis (LCCA), typically only document financial (economic) expenditures while non-cash benefits (social and environmental components) may be largely undocumented and not accounted for in traditional financial analyses.

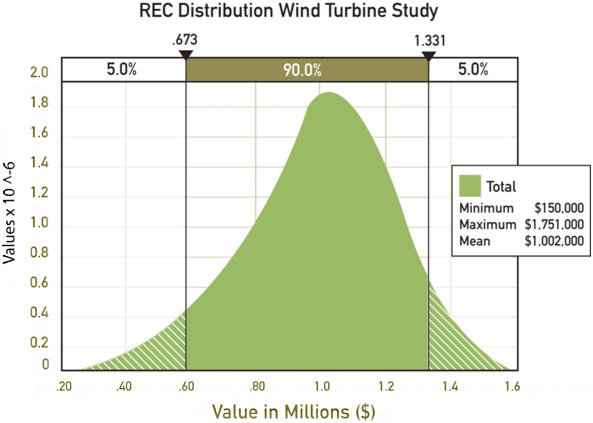

Image Courtesy of URS Corp.

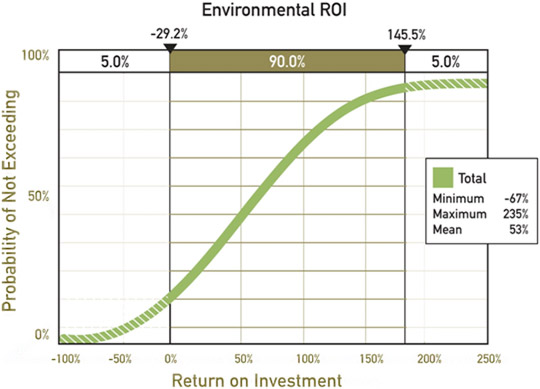

It is important to note that a sROI analysis in addition to a full TBL accounting also provides the equivalent of traditional life-cycle cost metrics, which are called Financial Return On Investment (FROI). FROI accounts for internal cash costs and benefits only while sROI accounts for all internal and external costs and benefits. sROI supplements traditional performance measures to help clients, owners and federal agencies integrate sustainability into their current decision-making process. Providing both FROI and sROI monetary outcomes allows client and stakeholders to make informed decisions that will optimize project outcomes. The built environment has become increasingly complex and integrated. Many project types have life-cycle, operational and maintenance costs that dwarf initial capital costs. Therefore, long-term sustainable and energy use strategies are needed to provide owners with transformational and economically justifiable outcomes needed for these investments. sROI’s key feature is that it monetizes all social and environmental impacts related to a given set of sustainability, environmental and energy strategies for a project. The other significant sROI benefit is that it accounts for risk and uncertainty. Most life-cycle cost analyses select a single set of values or a point in time for values in their model. More likely is that throughout a project’s lifetime one would see incredible price swings in the cost of a barrel of oil, value of a ton of carbon, cost of a kilowatt hour or government subsidy for renewable energy. It is important to capture this range of values. sROI models account for this uncertainty and the broad range of values that these variables can entail. It also accounts for the low, high and mean values of these items in lieu of selecting a single value for each. The table below reflects a simulation that resulted in the output distribution showing probability of a particular outcome.

Image Courtesy of URS Corp.

One significant TBL milestone is that this methodology has been adopted by the U.S. Federal government. In 2009 President Obama issued Executive Order 13514, which states: “. . . to establish an integrated strategy towards sustainability in the Federal Government and to make reduction of greenhouse gas emissions a priority . . . agencies shall prioritize actions based on a full accounting of both economic and social benefits and costs.”

As a result of EO 13514, federal agencies have a mandate to report capital, social and environmental costs and benefits and to use this methodology in their decision-making. The Department of Defense – Military Health System (MHS) group has determined that sROI is the preferred methodology for capturing and reporting this information. sROI has become transformational in that sustainable strategies and decisions made by the government must now be justifiable, demonstrate ROI for the taxpayer and eliminate emotion and “green agendas” from the process. The sROI process will not “green wash” a sustainable strategy. If it does not provide a positive ROI, it will be revealed in sROI.

Image Courtesy of URS Corp.

sROI methodology has the potential to document transformational outcomes. Implementing sustainable design strategies without an integrated approach to optimizing benefits of these strategies can create potential problems on a project. Sustainable design has matured to the point where clients need a Return On Investment (ROI) for these strategies that can be reported to their constituencies (Commanders, CEO’s, Trustees and Shareholders). Full integration of sROI analysis with design of a facility is how these transformational outcomes are achieved. Within architecture and engineering, projects need to be designed holistically with all subject matter experts (planners, architects, engineers and sustainability experts) integrated and contributing to the optimized design result. Sustainable strategies need to be not only economically viable but also must support the mission and client goals in a facility.

One example of sROI use to develop a comprehensive sustainability strategy was the approach adopted by a major research university. The university documented numerous buildings on its campus under LEED EB. They developed a comprehensive sustainability strategy to minimize energy and water use while improving indoor and environmental air quality. By creating a comprehensive sustainability strategy, the university has created a work environment that not only is healthier for its occupants but also gives it an edge in the all-important faculty and student recruitment wars. Employees (and especially younger staff) want to work in healthy, sustainable, clean environments with high indoor air quality and lots of natural light.

These same qualities in improving a facility work environment also have been documented to improve patient outcomes in medical facilities. The ever increasing cost of providing healthcare requires that hospitals examine every possible methodology for improving patient outcomes and reducing infections and re-admissions. Medical facilities provide excellent opportunities to implement sustainable design strategies that complement Evidence Based Design (EBD) criteria for improved patient outcomes. The integration of EBD features with rigorously reviewed comprehensive sustainability strategies has the potential to optimize design of a healthcare facility, to create transformational outcomes and to improve delivery of healthcare. Improved infection control measures have tremendous financial and TBL upside. The value of reduced infections and re-admissions (with correspondingly reduced costs and potential lives saved) has a definable, measurable beneficial outcome for any medical institution.

The ability of planners, architects, engineers and sustainability experts to demonstrably show improved health outcomes through various sustainable design strategies has the potential to be a watershed moment in the architecture and engineering professions. Additionally, implementing Evidence Based Design features with measurable economic benefits brings credibility to the design team. By bringing the rigor of sROI to the design table, the design team can focus on optimizing a facility in the earliest phases of a project. In fact, ideal use of sROI starts in the pre-design phase to facilitate the process of stakeholder integration as early as possible in the project.

This has several benefits:

- It informs design – design features can be objectively measured for their beneficial contribution to owner criteria and goals;

- It galvanizes stakeholder decision-making process;

- It documents team decisions; and

- It documents “roads not taken” (decisions on strategies not pursued).

Many of the most complex projects take years to complete. Oftentimes the owner’s team and other stakeholders change, and the ability to “revisit” past decisions is critical. Building teams with hard economic analysis methodologies will stand-up to the test of review, challenges and second-guessing. The ability to document sustainable design decisions with an economic analysis showing a Return On Investment (ROI) is invaluable to the project team and, especially, the owner.

Owners need a comprehensive analysis of their project’s potential outcomes and any threats to success. sROI analysis looks at sustainable design, programmatic and mission outcome cost and benefit issues related to sustainability, environmental and energy strategies. RISQUE analysis looks at hurdles, which can impact a project and that may or may not be out of the team’s control to affect. Acts of God and other aspects of project disruption that cannot be controlled by the team can be analyzed. In addition, risk elements with the opportunity to have their outcomes affected by the team can be identified and quantified while stakeholders can determine the best method to address them.

RISQUE analysis that goes the extra step to document potential risk components may include:

- What is the risk of doing the project versus doing nothing at all?

- What would be the impact of a labor strike?

- How is the schedule and cost of a project affected by a material shortage?

- How does the fluctuating cost of energy impact the project?

- What may be the impact of natural or man-made disasters? Weather events?

- What is the risk of environmental degradation or species loss?

- What would be the impact of community or zoning/permit challenges or opposition?

sROI promotes sustainable investment strategies from an objective and transparent perspective linked to the triple bottom line ROI of a project. Opportunity to integrate sROI with the design process allows architects and engineers to develop transformational outcomes for optimization of the Nation’s buildings, infrastructure and built environment.

Benefits of Using sROI & RISQUE

- It is a proven “State of the Art,” Cost-Benefit Analysis-based approach to making planning & budgeting decisions.

- It fully incorporates non-cash cost, benefits and externalities into the decision-making process.

- It provides a full range of possible outcomes, thus reducing uncertainty.

- It can document and make the risk management process transparent.

- It can translate risk factors into financial terms.

- It includes and enhances the Life-Cycle Cost Analysis process.

- It helps generate consensus by being both interactive and transparent.

- It takes emotion out of the process.

- It is Objective & Auditable.

- It does not “green wash” a project or strategy.

- It is an invaluable tool to help clients justify and get funding.

With these benefits, sROI and RISQUE present an opportunity for the design team to leverage and use state-of-the-art analysis and methodologies with roots in the “dismal science” while optimizing design of a facility with potentially transformational outcomes.