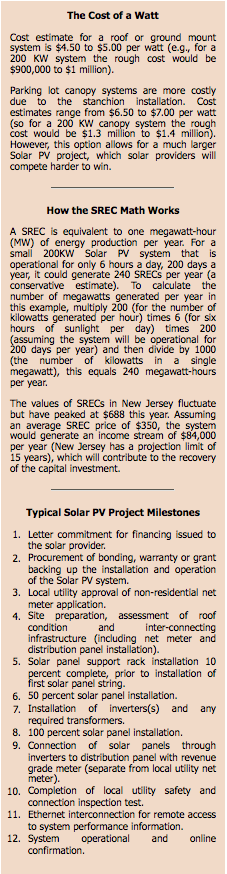

Capturing the Value in Solar Renewable Energy Projects

With budget dollars harder to find for energy and facility upgrades, solar power projects are offering new ways to cover and reduce costs. While it is unlikely with current technology that solar power will replace fossil fuel as our largest source for electricity2 , solar power is a crucial component of renewable energy production. An important and evolving concept in building and community design is to decentralize power production so each building achieves zero-net energy consumption3 , and solar power is the most adaptable solution in achieving this goal. The Federal government and many states are finding creative ways to encourage public and private investment in solar power projects. The resulting incentives have allowed solar installation companies and their investors to develop profitable business models in selling these projects to property owners. The extent to which these projects pass on value, opportunities and risks to property owners vary greatly, so it is important to understand the negotiable aspects and structure of the deal. Continue reading for tools to make more informed decisions as a property owner considering a solar power project.

The use of solar photovoltaic (Solar PV) systems has been growing throughout the world as a clean and renewable source of electricity. In 2009 Solar PV accounted for almost 16 percent of new electric power capacity additions in Europe4 , and the United States added an estimated 470 megawatts

(MW)5 . In October 2010 an 80MW solar farm, the world’s largest operating photovoltaic facility, came online in Ontario, Canada. It will power 12,800 homes6 .

Development of the U.S. Solar PV industry has been driven by a variety of incentive programs provided by various levels of government and private utilities. In addition to Federal tax incentives, states and public and private utilities also offer rebates and renewable energy credits that offset the capital costs, encourage financing and, in a growing number of transactions, reduce the property owner’s initial capital outlay to zero.

Unused surface area can now help lower energy cost and, in turn, reduce carbon emissions. Typically, systems are installed on roofs, parking area canopies or ground mounted in open areas. Infrastructure conditions, such as of the roof and electrical distribution system equipment, will impact the true cost and value of a Solar PV project on any property. However, the expense of required upgrades can be priced into the project costs.

Unused surface area can now help lower energy cost and, in turn, reduce carbon emissions. Typically, systems are installed on roofs, parking area canopies or ground mounted in open areas. Infrastructure conditions, such as of the roof and electrical distribution system equipment, will impact the true cost and value of a Solar PV project on any property. However, the expense of required upgrades can be priced into the project costs.

1. Incentives

To encourage investment in renewable energy, the Federal government allows a 30 percent tax credit of equipment cost (including labor cost for installation and fees) that uses solar energy to generate electricity. 7 Unused credits can be carried forward for up to 20 years for commercial property owners and up until 2016 for residential. If construction begins before the end of 2011, in lieu of a tax credit, commercial taxpayers can receive a grant in the same amount from the U.S. Treasury Department8 .

An additional tax incentive is the accelerated depreciation under the Modified Accelerated Cost-Recovery System (MACRS). Under MACRS, businesses may recover investments in solar technology (as well as other renewable energy technologies) through depreciation deductions over a five-year period. Solar facilities put into service during 2010 are eligible for 50 percent depreciation in the first year9.

A number of states have legislated a Renewable Portfolio Standard (RPS) – a regulation that requires increased energy production from renewable energy sources. An RPS creates a market demand within a particular state or region for tradable renewable energy credits that can be sold for cash. Solar Renewable Energy Credits (SRECs) are credits existing in states that specifically require solar energy to make up part of the portfolio. A Solar PV system generates a SREC by producing a MW of electricity. Property owners can sell their SRECs through spot market sales or long-term sales contracts, dramatically shortening their investment recovery period. Although RPSs vary between states, New Jersey has experienced successful growth in its SREC market, thus making it a favorable location for solar power projects. The state has achieved 200 MWs of solar capacity with more than 6,800 projects10 .

2. The Power Purchase Agreement

Public, private and non-profit entities unable to take advantage of Federal tax incentives, either because they do not pay taxes or do not produce enough income, can partner with a third party solar company and still gain the benefits of energy cost savings and stabilization of rate escalation with zero capital investment or payout obligation. By leasing the part of the property that will be used for the Solar PV system (such as the unused roof space), the solar provider will own the Solar PV system – and the tax benefits and SRECs – and sell the electrical output to the property owner. The property owner will gain substantial savings on their energy costs (not only by price per kilowatt but, more importantly, by reduction in escalation over a 15 to 20 year term) and the satisfaction of replacing a portion of the energy they consume with clean solar power. This arrangement is governed by a Power Purchase Agreement (PPA).

Conceptually, the PPA is a simple agreement. However, its terms (which are full of technical and electrical jargon) reflect the economics of a sophisticated SREC marketplace and transfer risks that require specialized expertise to understand and to negotiate. Unfortunately, by the time the property owner selects a solar provider and receives the proposed PPA, much of the potential value will have been given away and unnecessary risks unwittingly assumed. Why is this?

© iStockphoto.com/LL28

Solar providers each have their own form PPA that is carefully drafted to ensure the uncertainty and risk is shifted onto the property owner who is rarely in a position to assess and shoulder these risks. Even with the aid of an experienced attorney, it is a difficult task to negotiate each of these provisions back to neutral terms because they start out so unfavorably to the property owner. What is left is a PPA that locks in the owner while allowing the solar provider numerous outs to walk away if the deal no longer seems attractive enough to move forward. Although these terms are generally driven by criteria established by the solar provider’s investors and financiers, they often have more flexibility than their form PPA will indicate. How can an owner maximize the value received through a solar project? The answer is simple – shop around. However, it is important to be in the right store, with the right shopping list.

3. Competitive Selection for Solar Providers

As the owner, the first step should be to engage an independent advisor to act as representative and to help develop a term sheet – a shopping list – that reflects the specific needs and characteristics of one’s own property. This term sheet is used to draft a request for proposal (RFP) that will be distributed only to pre-qualified solar providers. The owner’s representative will know the capabilities of the players in the marketplace by their prior deal experience. Inviting to propose only pre-qualified solar providers, known to have the capacity and skill-sets to deliver, will save time and money, and ensure reliability during the operational life of the project. The owner gains several advantages with this approach:

- Transparency. The financial model that describes the transaction economics are rarely disclosed by a solar provider. However, pertinent information can be requested in the RFP to support a bid proposal. With this information in the open, it becomes possible to structure a deal that is unique to the owner’s specific needs, as the comparison pricing for different timelines and buy-out option pricing will be clearly described. The disclosure of a financial model will also support the owner’s assessment of the solar provider’s ability to perform its obligations throughout the project’s life.

- Financing Opportunities. The individual term sheet may include facility upgrades that can be financed through the project. In addition to minimizing the energy escalation cost at a stable rate, in lieu of taking the full discount on the price per kilowatt, the energy cost savings can be used to upgrade aging infrastructure, such as electrical equipment or roofs. 11 The independent advisor’s fees can also be priced into the project cost.

- Shared Value. With disclosure of a financial model that illustrates the value of the project through the life of the PPA, it may be possible to articulate a way to share in windfall SREC values in the event of an upward movement in spot market pricing.

- A Clear Approach. RFP responses should also establish an approach to the sequence of activities to be included in the PPA, which should be understood in advance of a commitment to proceed. Good practice is for the PPA to establish the milestones anticipated along with a delivery schedule.

4. PPA Pitfalls

There are a number of traps and pitfalls to avoid during a PPA negotiation. Some issues to be aware of include the following:

-

© iStockphoto.com/Pgiam

Environmental Attributes. Solar energy use will reduce the property owner’s carbon emissions and displace electricity generated with fossil fuel. This alone creates potentially valuable environmental attributes such as SRECs, green tags, carbon credits and other grants or subsidies under current or future private or governmental programs. Whether these attributes will accrue to the property owner or the solar provider is an important negotiating point. Although recent collapse of the Chicago Climate Exchange has decimated U.S. carbon credit values, 12 the owner should retain those attributes that are not used in the project’s financial model. Of course, the solar provider seeks to maximize ownership of various environmental attributes under its standard form PPA. In some cases, this may be necessary for the solar provider to then assign these rights in connection with certain renewable energy loan programs. However, unreasonably broad provisions may even include rights under demand response13 and other energy programs with the local utility. Understanding how the project will be financed is crucial to negotiating the right balance of benefits between owner and solar installer – another important reason to require the financial model in your RFP. For example, in a project financed by SRECs, if the value should dramatically increase during the contract term, this windfall should be shared between both parties.

- Revenue Grade Meter. A solar power system display panel should provide, among other things, the amounts of money saved, electricity generated and carbon emissions avoided. Many systems use an Internet connection combined with software to monitor data related to production. However, for purposes of validating energy billing information, a Solar PV system revenue grade meter is appropriate.14 This meter is separate from the net meter provided by the utility.

-

© iStockphoto.com/oonal

Warranties. The age and condition of the roof and electrical equipment should be considered before installing the Solar PV system. Upgrading or repairing these items during the term of a PPA, which is usually between 15 to 20 years, is more costly and difficult. Additionally, some roof warranties and insurance policies may be voided by installation of a Solar PV system if certain prerequisite approvals and precautions are not taken. The solar provider should be responsible for identifying proper warranty documents and obtaining certification from the manufacturer saying the project will not disturb the warranty. The solar provider should also be obligated and prepared to indemnify the owner in case of equipment damage or if any warranties are voided.

- Levels of Productions. It is important to ensure the solar provider properly maintains the Solar PV system so it performs within acceptable production range. Promised reductions in energy costs will not be realized if the condition of the Solar PV system is allowed to deteriorate over the operational life of the PPA. To protect the owner, there should be some minimum threshold level of energy production.

Likewise, it is important to make sure the Solar PV system is appropriately sized so it does not consistently generate more power than the property consumes over a 12-month period. When the property needs power, the electricity will be drawn from the solar panels and the remaining need will be drawn from the utility. When the property needs less power than is produced by the solar panels, the excess electricity will be sold onto the grid at the retail rate. This will create a revenue stream that will offset energy costs and can often be seen on the utility bill. However, although every state is different15, generally after 12 months as a net producer, the utility could apply a wholesale rate that may collapse the financial model supporting the project.

5. The Future is Bright

Solar power projects are full of opportunities to lower operating costs and finance facility and infrastructure upgrades. When structured correctly, these projects are a win-win for all parties. In this difficult economic climate, it’s time to get creative with financial resources, so feel free to tighten up the purse strings and clean up the roof instead.

© iStockphoto.com/Kativ